Learn how FortStock is using the XRP Ledger’s Multi-Purpose Token (MPT) standard to turn idle warehouse inventory into usable collateral.

Global trade moves over $25 trillion in goods every year. Containers cross oceans, fill warehouses, and wait silently at distribution centers. Yet much of this physical inventory remains frozen in financial terms - unleveraged, undocumented in capital markets, and untapped as collateral.

This reality is more than a quirk of trade logistics. It creates a multi-trillion-dollar inefficiency. According to the ADB and WTO, the global trade finance gap now stands between $2.5 and $5 trillion - a hole that disproportionately impacts the very economies most dependent on trade: emerging markets.

At FortStock, we believe there is a better way. We’re building an infrastructure where warehouse receipts become programmable financial assets that can be used as collateral for short-term credit. But to do that, we needed more than just tokenization. We needed a token format that could carry real-world logic - not just data. That’s where the XRP Ledger’s Multi-Purpose Token (MPT) standard comes in.

To bring real-world assets like warehouse receipts into on-chain finance, a token must do more than simply represent ownership. It needs to function as a true digital contract, with its rules and data deeply integrated at the ledger level. Capturing the complexity of a regulated financial instrument has been the primary challenge in bridging physical collateral with digital liquidity.

The MPT standard is engineered to solve this, offering precisely the functionality FortStock needed:

- A way to embed legally relevant metadata directly on-chain (e.g., warrant number, expiry date, or the hash of the original receipt).

- A token object that reflects the full lifecycle of an asset-from origination to collateralization to settlement-without requiring complex, external smart contracts.

With MPT, we can mirror how warehouse receipts and trade credit behave in the real world-but do it in a format that is native to blockchain and global from day one.

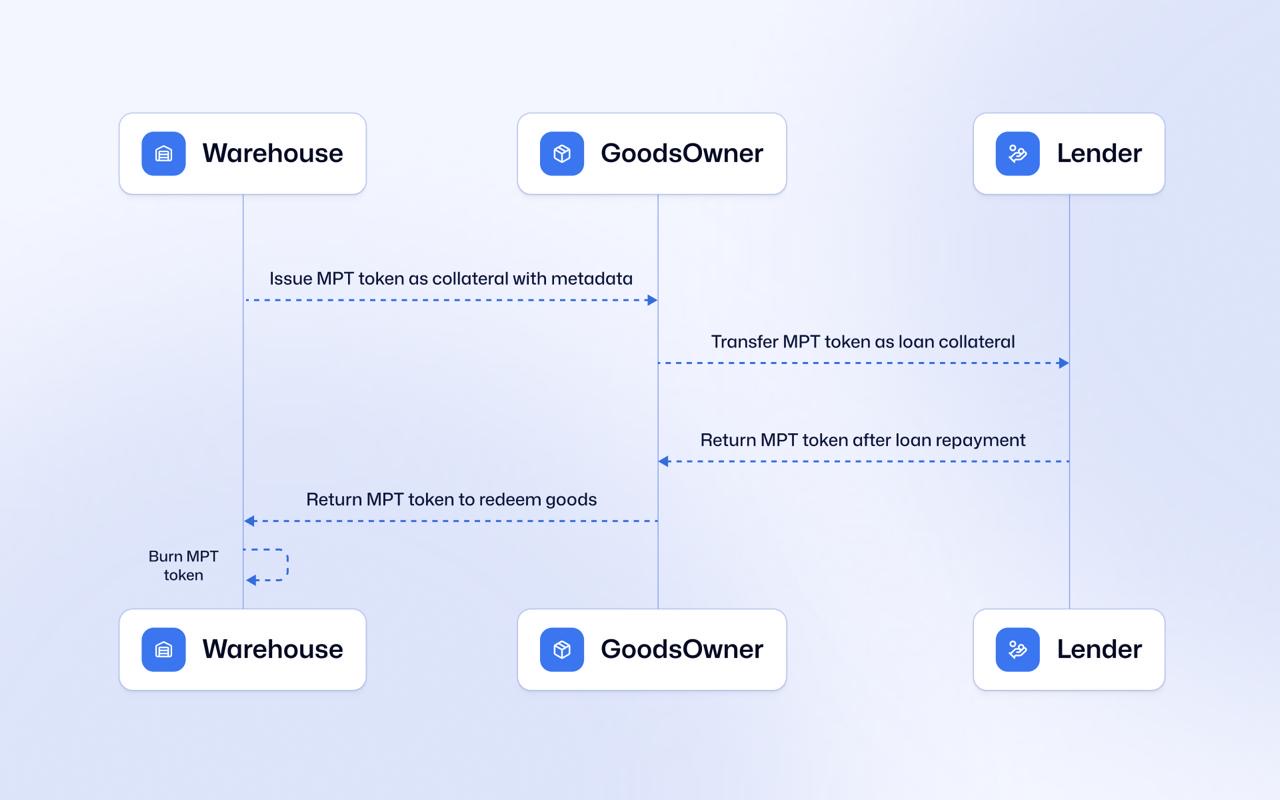

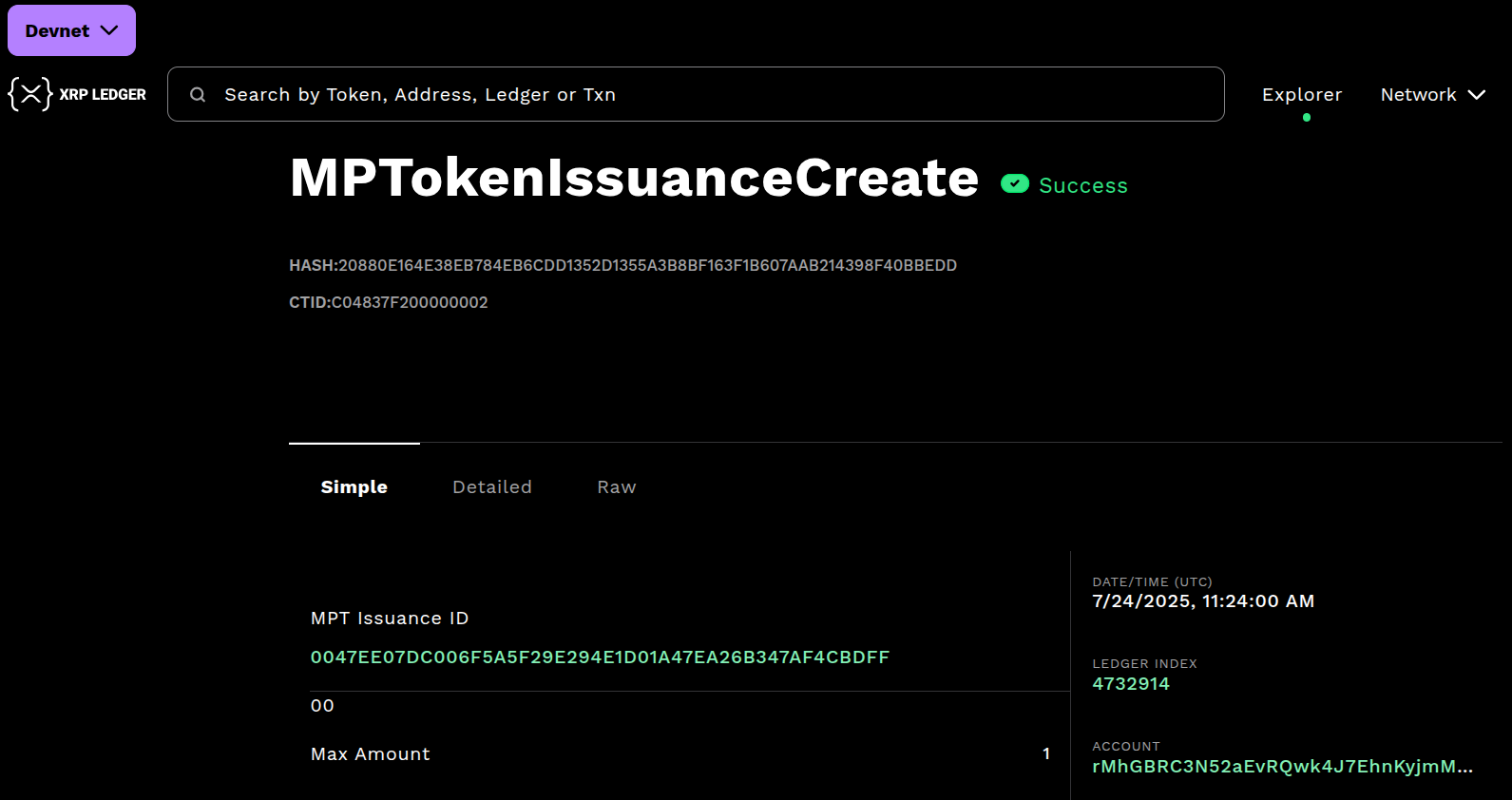

Earlier this month, we minted a sample MPT token on the XRP Ledger Devnet representing a pledged warehouse asset. This wasn’t a front-end simulation or a UI preview. This was the actual logic - executed and traceable on-chain.

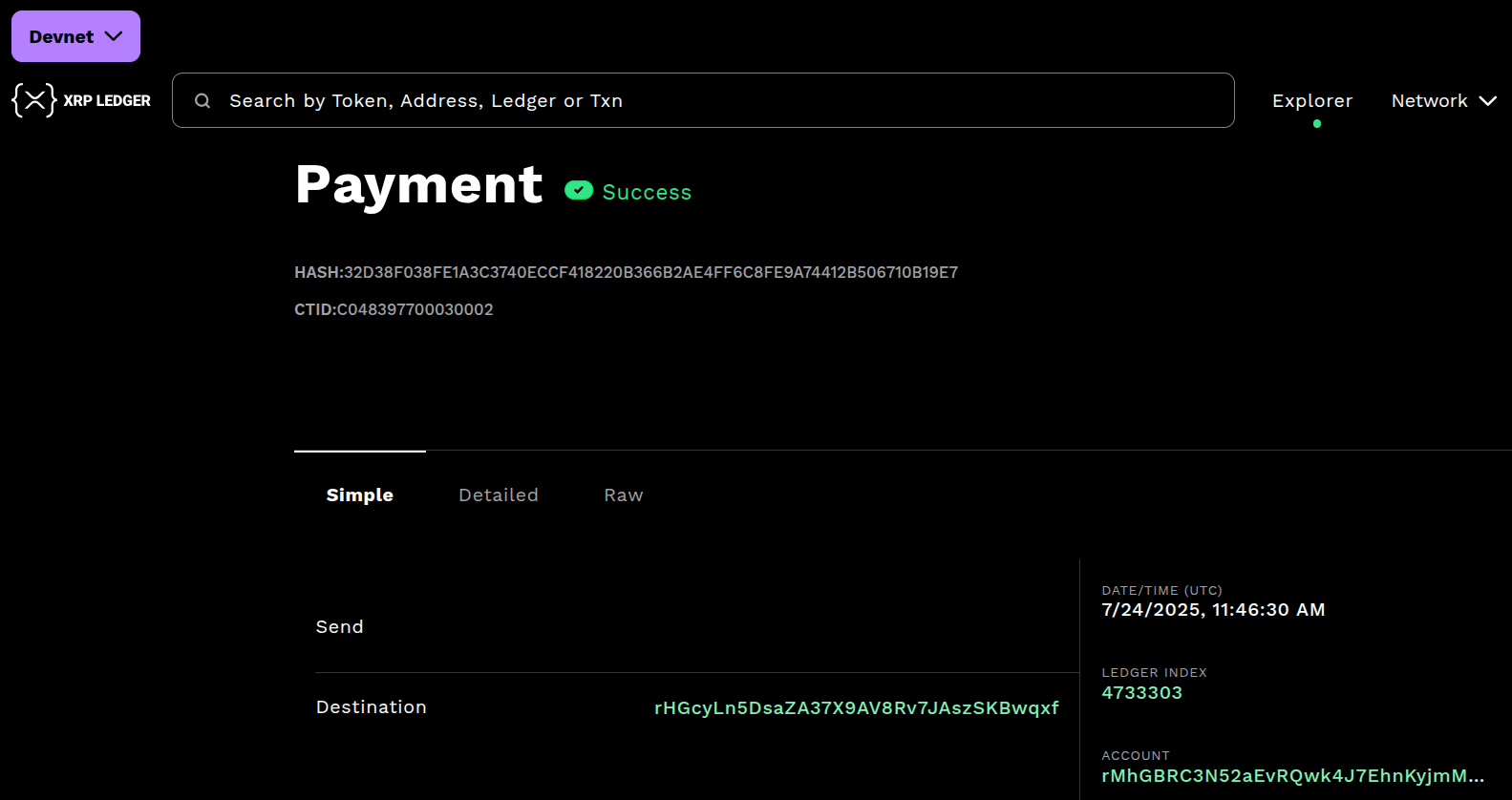

We then transferred the token to a creditor address, mimicking the pledge of collateral in a lending transaction. Finally, we returned and burned the token to close the loop, demonstrating how the asset lifecycle can be fully managed within the MPT framework.

These are test transactions, but the data is live, open, and verifiable by anyone:

Issuance of the warehouse receipt token with detailed memo fields.

Transfer to another wallet to simulate collateralization

This infrastructure does more than digitize documentation. It unlocks liquidity. When warehouse receipts are tokenized as MPTs, they can be linked to on-chain liquidity like RLUSD, once deployed on XRPL.

This means real-world borrowers can obtain real-time financing - not based on their credit history, but based on their inventory and logistics. The lenders, in turn, receive transparent tokens backed by physical goods.

A token can include context such as origin jurisdiction, commodity class, storage expiry, and audit trail, making it not only more secure but also de-risked by design.

This allows investors to access an attractive 8–12% yield that, unlike many DeFi protocols, is securely backed by real-world physical goods.

FortStock is continuing to develop this architecture with real warehouse partners, regulated lending institutions, and payment rails.

The XRP Ledger, with its native support for MPT, gives us the compliance-forward, fee-efficient, high-speed base layer we need to scale this model globally.

Because ultimately, programmable finance should start with real assets, not speculative tokens. With MPTs, we’re building exactly that - one warehouse at a time.