Trade with an AMM Auction Slot

Follow the steps from the Create an AMM tutorial before proceeding.

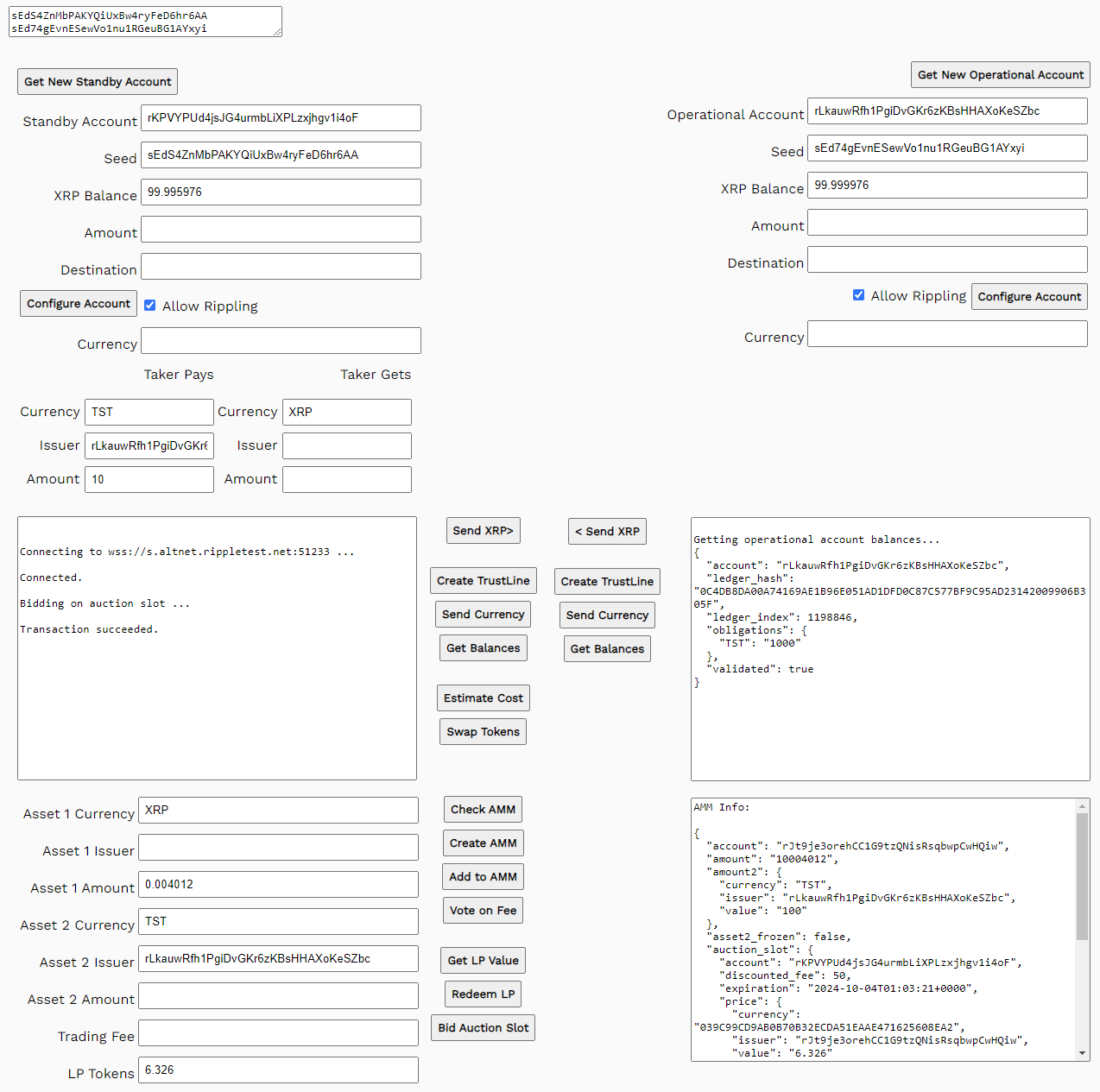

This example shows how to:

- Calculate the exact cost of swapping one token for another in an AMM pool.

- Check the difference in trading fees with and without an auction slot.

- Bid on an auction slot with LP tokens.

- Create an offer to swap tokens with the AMM.

You can download the Quickstart Samples archive to try each of the samples in your own browser.

Without the Quickstart Samples, you will not be able to try the examples that follow.

Usage

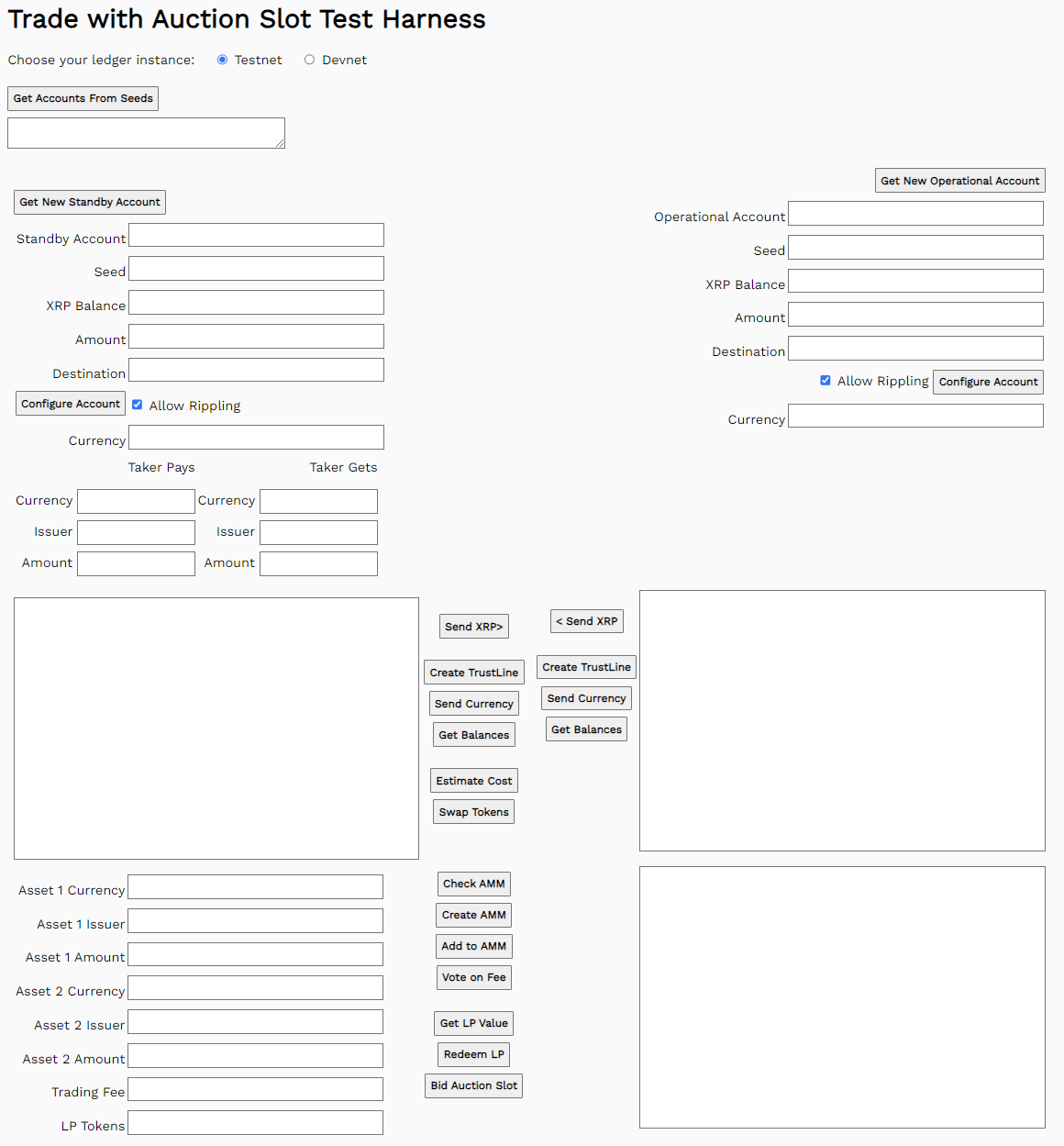

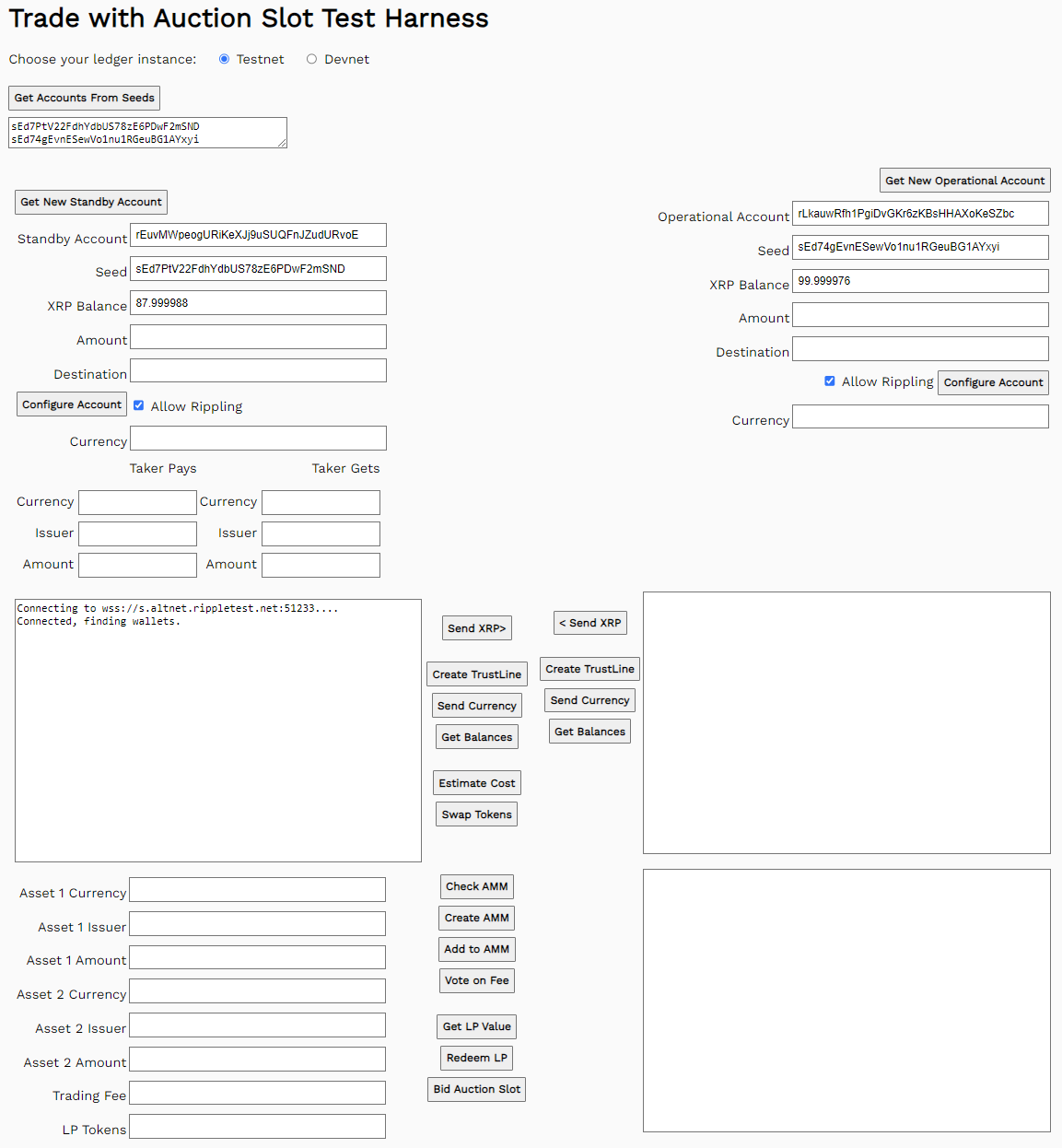

Get Accounts

- Open

13.trade-with-auction-slot.htmlin a browser. - Select Testnet or Devnet

- Get test accounts.

- If you have existing account seeds:

- Paste account seeds in the Seeds field.

- Click Get Accounts from Seeds.

- If you don't have account seeds:

- Click Get New Standby Account.

- Click Get New Operational Account.

- If you have existing account seeds:

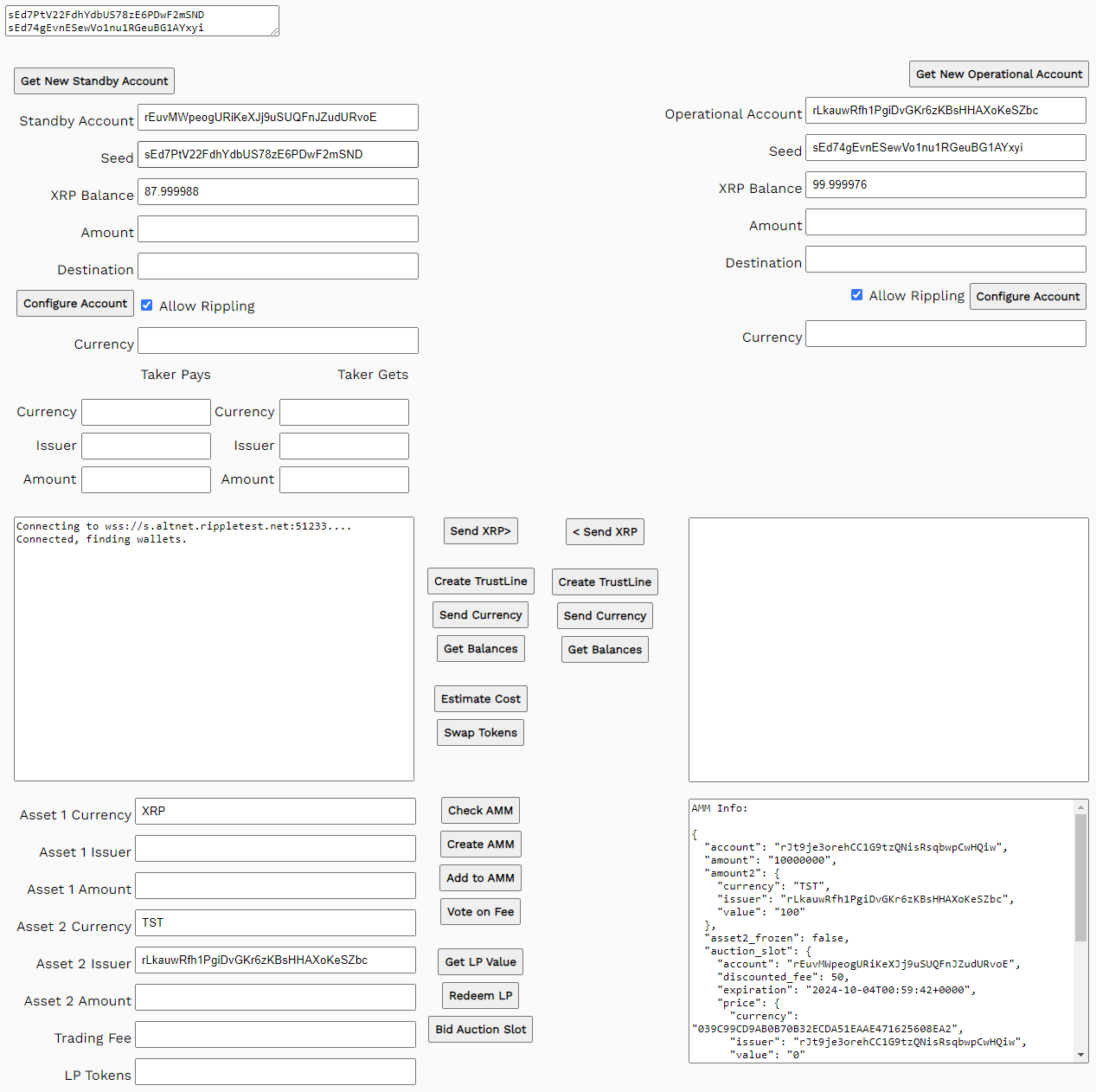

Get the AMM

Use the information from either the XRP/Token or Token/Token AMM you created in Create an AMM.

- Enter a currency code in the Asset 1 Currency field. For example,

XRP. - Enter a second currency code in the Asset 2 Currency field. For example,

TST. - Enter the operational account address in the Asset 2 Issuer field.

- Click Check AMM.

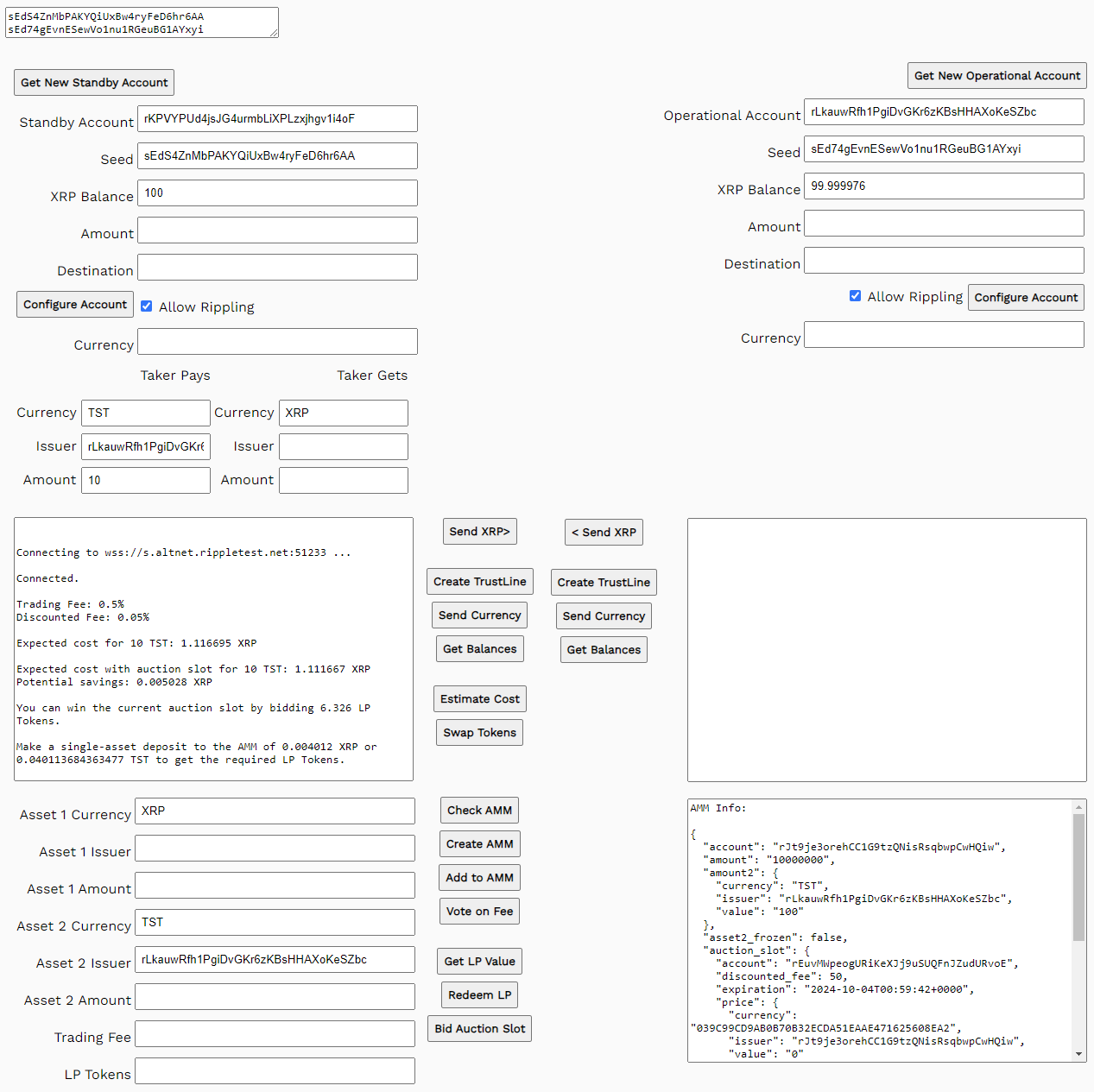

Estimate Costs

Get a new standby account to ensure you aren't using an account with an auction slot already.

- Click Get New Standby Account.

- Under the Taker Pays column:

- Enter a currency code in the Currency field. For example,

TST. - Enter the operational account address in the Issuer field.

- Enter an Amount. For example,

10.

- Enter a currency code in the Currency field. For example,

- Under the Taker Gets column, enter a currency code in the Currency field. For example,

XRP. - Click Estimate Cost.

- Save the values given by the estimate.

Bid for the Auction Slot

Make a single-asset deposit to the AMM to receive the required LP tokens for the auction slot bid. You can deposit either asset from the cost estimator.

- Enter the estimated deposit amount in either Asset 1 Amount or Asset 2 Amount. For example,

0.004012in Asset 1 Amount. - Click Add to AMM.

- Enter the estimated bid amount in the LP Tokens field. For example,

6.326. - Click Bid Auction Slot.

Swap Tokens with the AMM

Get a new estimate to update the expected cost for swapping tokens.

- Click Estimate Cost.

- Under the Taker Gets Column, enter an Amount. Use the expected cost with an auction slot from the estimate. For example,

1.112113. - Click Swap Tokens.

Code Walkthrough (ripplex13a-trade-with-auction-slot.js)

You can open ripplex13a-trade-with-auction-slot.js from the Quickstart Samples to view the source code.

Estimate AMM Costs

This function checks the cost of interactions with the AMM, such as deposits, auction slot bids, and token swaps.

async function estimateCost() {

Connect to the XRP Ledger.

let net = getNet() const client = new xrpl.Client(net) results = `\n\nConnecting to ${getNet()} ...` standbyResultField.value = results await client.connect() results += '\n\nConnected.' standbyResultField.value = results

Format the amm_info command and get the AMM information. This code is wrapped in a try-catch block to handle any errors.

try { const asset1_currency = asset1CurrencyField.value const asset1_issuer = asset1IssuerField.value const asset2_currency = asset2CurrencyField.value const asset2_issuer = asset2IssuerField.value // Look up AMM info let asset1_info = null let asset2_info = null if ( asset1_currency == 'XRP' ) { asset1_info = { "currency": "XRP" } } else { asset1_info = { "currency": asset1_currency, "issuer": asset1_issuer } } if ( asset2_currency == 'XRP' ) { asset2_info = { "currency": "XRP" } } else { asset2_info = { "currency": asset2_currency, "issuer": asset2_issuer } } const amm_info = (await client.request({ "command": "amm_info", "asset": asset1_info, "asset2": asset2_info })) // Save relevant AMM info for calculations const lpt = amm_info.result.amm.lp_token const pool_asset1 = amm_info.result.amm.amount const pool_asset2 = amm_info.result.amm.amount2 const full_trading_fee = amm_info.result.amm.trading_fee const discounted_fee = amm_info.result.amm.auction_slot.discounted_fee const old_bid = amm_info.result.amm.auction_slot.price.value const time_interval = amm_info.result.amm.auction_slot.time_interval results += `\n\nTrading Fee: ${full_trading_fee/1000}%\nDiscounted Fee: ${discounted_fee/1000}%`

Save the taker pays and taker gets fields; use these values to get the total amount of each asset in the AMM pool, using large significant digits for precise calculations. This also checks if the requested token amount is larger than what is available in the AMM pool, stopping the code if true.

// Save taker pays and gets values. const takerPays = { "currency": standbyTakerPaysCurrencyField.value, "issuer": standbyTakerPaysIssuerField.value, "amount": standbyTakerPaysAmountField.value } const takerGets = { "currency": standbyTakerGetsCurrencyField.value, "issuer": standbyTakerGetsIssuerField.value, "amount": standbyTakerGetsAmountField.value } // Get amount of assets in the pool. // Convert values to BigNumbers with the appropriate precision. // Tokens always have 15 significant digits; // XRP is precise to integer drops, which can be as high as 10^17 let asset_out_bn = null let pool_in_bn = null let pool_out_bn = null let isAmmAsset1Xrp = false let isAmmAsset2Xrp = false if ( takerPays.currency == 'XRP' ) { asset_out_bn = BigNumber(xrpl.xrpToDrops(takerPays.amount)).precision(17) } else { asset_out_bn = BigNumber(takerPays.amount).precision(15) } if ( takerGets.currency == 'XRP' && asset1_currency == 'XRP' ) { pool_in_bn = BigNumber(pool_asset1).precision(17) isAmmAsset1Xrp = true } else if ( takerGets.currency == 'XRP' && asset2_currency == 'XRP' ) { pool_in_bn = BigNumber(pool_asset2).precision(17) isAmmAsset2Xrp = true } else if ( takerGets.currency == asset1_currency ) { pool_in_bn = BigNumber(pool_asset1.value).precision(15) } else { pool_in_bn = BigNumber(pool_asset2.value).precision(15) } if (takerPays.currency == 'XRP' && asset1_currency == 'XRP' ) { pool_out_bn = BigNumber(pool_asset1).precision(17) } else if ( takerPays.currency == 'XRP' && asset2_currency == 'XRP' ) { pool_out_bn = BigNumber(pool_asset2).precision(17) } else if ( takerPays.currency == asset1_currency ) { pool_out_bn = BigNumber(pool_asset1.value).precision(15) } else { pool_out_bn = BigNumber(pool_asset2.value).precision(15) } if ( takerPays.currency == 'XRP' && parseFloat(takerPays.amount) > parseFloat(xrpl.dropsToXrp(pool_out_bn)) ) { results += `\n\nRequested ${takerPays.amount} ${takerPays.currency}, but AMM only holds ${xrpl.dropsToXrp(pool_out_bn)}. Quitting.` standbyResultField.value = results client.disconnect() return } else if ( parseFloat(takerPays.amount) > parseFloat(pool_out_bn) ) { results += `\n\nRequested ${takerPays.amount} ${takerPays.currency}, but AMM only holds ${pool_out_bn}. Quitting.` standbyResultField.value = results client.disconnect() return }

Use AMM helper functions to estimate values for:

- Cost to swap token without an auction slot.

- Cost to swap token with an auction slot.

- LP tokens to win an auction slot. This value factors the increase in the minimum bid of having new LP tokens issued to you from your deposit.

- The amount of tokens for single-asset deposits to get the required LP tokens to win the auction slot.

// Use AMM's SwapOut formula to figure out how much of the takerGets asset // you have to pay to receive the target amount of takerPays asset const unrounded_amount = swapOut(asset_out_bn, pool_in_bn, pool_out_bn, full_trading_fee) // Drop decimal places and round ceiling to ensure you pay in enough. const swap_amount = unrounded_amount.dp(0, BigNumber.ROUND_CEIL) // Helper function to convert drops to XRP in log window function convert(currency, amount) { if ( currency == 'XRP' ) { amount = xrpl.dropsToXrp(amount) } return amount } results += `\n\nExpected cost for ${takerPays.amount} ${takerPays.currency}: ${convert(takerGets.currency, swap_amount)} ${takerGets.currency}` // Use SwapOut to calculate discounted swap amount with auction slot const raw_discounted = swapOut(asset_out_bn, pool_in_bn, pool_out_bn, discounted_fee) const discounted_swap_amount = raw_discounted.dp(0, BigNumber.ROUND_CEIL) results += `\n\nExpected cost with auction slot for ${takerPays.amount} ${takerPays.currency}: ${convert(takerGets.currency, discounted_swap_amount)} ${takerGets.currency}` // Calculate savings by using auction slot const potential_savings = swap_amount.minus(discounted_swap_amount) results += `\nPotential savings: ${convert(takerGets.currency, potential_savings)} ${takerGets.currency}` // Calculate the cost of winning the auction slot, in LP Tokens. const auction_price = auctionDeposit(old_bid, time_interval, full_trading_fee, lpt.value).dp(3, BigNumber.ROUND_CEIL) results += `\n\nYou can win the current auction slot by bidding ${auction_price} LP Tokens.` // Calculate how much to add for a single-asset deposit to receive the target LP Token amount let deposit_for_bid_asset1 = null let deposit_for_bid_asset2 = null if ( isAmmAsset1Xrp == true ) { deposit_for_bid_asset1 = xrpl.dropsToXrp(ammAssetIn(pool_asset1, lpt.value, auction_price, full_trading_fee).dp(0, BigNumber.ROUND_CEIL)) } else { deposit_for_bid_asset1 = ammAssetIn(pool_asset1.value, lpt.value, auction_price, full_trading_fee).dp(15, BigNumber.ROUND_CEIL) } if ( isAmmAsset2Xrp == true ) { deposit_for_bid_asset2 = xrpl.dropsToXrp(ammAssetIn(pool_asset2, lpt.value, auction_price, full_trading_fee).dp(0, BigNumber.ROUND_CEIL)) } else { deposit_for_bid_asset2 = ammAssetIn(pool_asset2.value, lpt.value, auction_price, full_trading_fee).dp(15, BigNumber.ROUND_CEIL) } if ( isAmmAsset1Xrp == true ) { results += `\n\nMake a single-asset deposit to the AMM of ${deposit_for_bid_asset1} XRP or ${deposit_for_bid_asset2} ${pool_asset2.currency} to get the required LP Tokens.` } else if ( isAmmAsset2Xrp == true ) { results += `\n\nMake a single-asset deposit to the AMM of ${deposit_for_bid_asset1} ${pool_asset1.currency} or ${deposit_for_bid_asset2} XRP to get the required LP Tokens.` } else { results += `\n\nMake a single-asset deposit to the AMM of ${deposit_for_bid_asset1} ${pool_asset1.currency} or ${deposit_for_bid_asset2} ${pool_asset2.currency} to get the required LP Tokens.` } } catch (error) { results += `\n\n${error.message}` }

Report the estimated values and close the client connection.

standbyResultField.value = results client.disconnect() }

Bid on the Auction Slot

This function bids on the AMM auction slot, using LP tokens.

async function bidAuction() {

Connect to the ledger.

let net = getNet() const client = new xrpl.Client(net) results = `\n\nConnecting to ${getNet()} ...` standbyResultField.value = results await client.connect() results += '\n\nConnected.' standbyResultField.value = results

Format the asset values, depending on if it's XRP or a token. Wrap the code in a try-catch block to handle any errors.

try { const standby_wallet = xrpl.Wallet.fromSeed(standbySeedField.value) const asset1_currency = asset1CurrencyField.value const asset1_issuer = asset1IssuerField.value const asset2_currency = asset2CurrencyField.value const asset2_issuer = asset2IssuerField.value const valueLPT = standbyLPField.value // Look up AMM info let asset1_info = null let asset2_info = null if ( asset1_currency == 'XRP' ) { asset1_info = { "currency": "XRP" } } else { asset1_info = { "currency": asset1_currency, "issuer": asset1_issuer } } if ( asset2_currency == 'XRP' ) { asset2_info = { "currency": "XRP" } } else { asset2_info = { "currency": asset2_currency, "issuer": asset2_issuer } } const amm_info = (await client.request({ "command": "amm_info", "asset": asset1_info, "asset2": asset2_info })) // Save relevant AMM info for calculations const lpt = amm_info.result.amm.lp_token results += '\n\nBidding on auction slot ...' standbyResultField.value = results

Submit the AMMBid transaction.

const bid_result = await client.submitAndWait({ "TransactionType": "AMMBid", "Account": standby_wallet.address, "Asset": asset1_info, "Asset2": asset2_info, "BidMax": { "currency": lpt.currency, "issuer": lpt.issuer, "value": valueLPT }, "BidMin": { "currency": lpt.currency, "issuer": lpt.issuer, "value": valueLPT } // So rounding doesn't leave dust amounts of LPT }, {autofill: true, wallet: standby_wallet}) if (bid_result.result.meta.TransactionResult == "tesSUCCESS") { results += `\n\nTransaction succeeded.` checkAMM() } else { results += `\n\nError sending transaction: ${JSON.stringify(bid_result.result.meta.TransactionResult, null, 2)}` } } catch (error) { results += `\n\n${error.message}` }

Report the results.

standbyResultField.value = results client.disconnect() }

Swap AMM Tokens

This function submits an OfferCreate transaction, using precise values to format the transaction and have the AMM completely consume the offer.

async function swapTokens() {

Connect to the XRP Ledger.

let net = getNet() const client = new xrpl.Client(net) results = `\n\nConnecting to ${getNet()} ...` standbyResultField.value = results await client.connect() results += '\n\nConnected.' standbyResultField.value = results

Get the taker pays and taker gets fields and format the amounts depending on if it's XRP or a custom token. Wrap the code in a try-catch block to handle any errors.

try { const standby_wallet = xrpl.Wallet.fromSeed(standbySeedField.value) const takerPaysCurrency = standbyTakerPaysCurrencyField.value const takerPaysIssuer = standbyTakerPaysIssuerField.value const takerPaysAmount = standbyTakerPaysAmountField.value const takerGetsCurrency = standbyTakerGetsCurrencyField.value const takerGetsIssuer = standbyTakerGetsIssuerField.value const takerGetsAmount = standbyTakerGetsAmountField.value let takerPays = null let takerGets = null if ( takerPaysCurrency == 'XRP' ) { takerPays = xrpl.xrpToDrops(takerPaysAmount) } else { takerPays = { "currency": takerPaysCurrency, "issuer": takerPaysIssuer, "value": takerPaysAmount } } if ( takerGetsCurrency == 'XRP' ) { takerGets = xrpl.xrpToDrops(takerGetsAmount) } else { takerGets = { "currency": takerGetsCurrency, "issuer": takerGetsIssuer, "value": takerGetsAmount } } results += '\n\nSwapping tokens ...' standbyResultField.value = results

Submit the OfferCreate transaction.

const offer_result = await client.submitAndWait({ "TransactionType": "OfferCreate", "Account": standby_wallet.address, "TakerPays": takerPays, "TakerGets": takerGets }, {autofill: true, wallet: standby_wallet}) if (offer_result.result.meta.TransactionResult == "tesSUCCESS") { results += `\n\nTransaction succeeded.` checkAMM() } else { results += `\n\nError sending transaction: ${JSON.stringify(offer_result.result.meta.TransactionResult, null, 2)}` } } catch (error) { results += `\n\n${error.message}` }

Report the results.

standbyResultField.value = results client.disconnect() }

Code Walkthrough (ripplex13b-amm-formulas.js)

You can open ripplex13b-amm-formulas.js from the Quickstart Samples to view the source code. This tutorial uses three of the available AMM helper functions.

swapOut()

The swapOut() function calculates how much of an asset you must deposit into an AMM to receive a specified amount of the paired asset. The input asset is what you're adding to the pool (paying), and the output asset is what you're receiving from the pool (buying).

The formula used is based on AMM Swap, defined in XLS-30.

| Parameter | Type | Description |

|---|---|---|

| asset_out_bn | BigNumber | The target amount to receive from the AMM. |

| pool_in_bn | BigNumber | The amount of the input asset in the AMM's pool before the swap. |

| pool_out_bn | BigNumber | The amount of the output asset in the AMM's pool before the swap. |

| trading_fee | int | The trading fee as an integer {0, 1000} where 1000 represents a 1% fee. |

| Returns | Type | Description |

|---|---|---|

| Return Value | BigNumber | The amount of the input asset that must be swapped in to receive the target output amount. Unrounded, because the number of decimals depends on if this is drops of XRP or a decimal amount of a token; since this is a theoretical input to the pool, it should be rounded up (ceiling) to preserve the pool's constant product. |

function swapOut(asset_out_bn, pool_in_bn, pool_out_bn, trading_fee) { return ( ( pool_in_bn.multipliedBy(pool_out_bn) ).dividedBy( pool_out_bn.minus(asset_out_bn) ).minus(pool_in_bn) ).dividedBy(feeMult(trading_fee)) }

auctionDeposit()

The auctionDeposit() calculates how many LP tokens you need to spend to win the auction slot. The formula assumes you don't have any LP tokens and factors in the increase in LP tokens issued when you deposit assets. If you already have LP tokens, you can use the auctionPrice() function instead.

The formula used is based on the slot pricing algorithm defined in XLS-30.

function auctionDeposit(old_bid, time_interval, trading_fee, lpt_balance) { const tfee_decimal = feeDecimal(trading_fee) const lptokens = BigNumber(lpt_balance) const b = BigNumber(old_bid) let outbidAmount = BigNumber(0) // This is the case if time_interval >= 20 if (time_interval == 0) { outbidAmount = b.multipliedBy("1.05") } else if (time_interval <= 19) { const t60 = BigNumber(time_interval).multipliedBy("0.05").exponentiatedBy(60) outbidAmount = b.multipliedBy("1.05").multipliedBy(BigNumber(1).minus(t60)) } const new_bid = lptokens.plus(outbidAmount).dividedBy( BigNumber(25).dividedBy(tfee_decimal).minus(1) ).plus(outbidAmount) // Significant digits for the deposit are limited by total LPTokens issued // so we calculate lptokens + deposit - lptokens to determine where the // rounding occurs. We use ceiling/floor to make sure the amount we receive // after rounding is still enough to win the auction slot. const rounded_bid = new_bid.plus(lptokens).precision(15, BigNumber.CEILING ).minus(lptokens).precision(15, BigNumber.FLOOR) return rounded_bid }

ammAssetIn()

The ammAssetIn() function calculates how much to add in a single-asset deposit to receive a specified amount of LP tokens.

| Parameter | Type | Description |

|---|---|---|

| pool_in | string | The quantity of the input asset the pool already has. |

| lpt_balance | string | The quantity of LP tokens already issued by the AMM. |

| desired_lpt | string | The quantity of new LP tokens you want to receive. |

| trading_fee | int | The trading fee as an integer {0, 1000} where 1000 represents a 1% fee. |

function ammAssetIn(pool_in, lpt_balance, desired_lpt, trading_fee) { // convert inputs to BigNumber const lpTokens = BigNumber(desired_lpt) const lptAMMBalance = BigNumber(lpt_balance) const asset1Balance = BigNumber(pool_in) const f1 = feeMult(trading_fee) const f2 = feeMultHalf(trading_fee).dividedBy(f1) const t1 = lpTokens.dividedBy(lptAMMBalance) const t2 = t1.plus(1) const d = f2.minus( t1.dividedBy(t2) ) const a = BigNumber(1).dividedBy( t2.multipliedBy(t2)) const b = BigNumber(2).multipliedBy(d).dividedBy(t2).minus( BigNumber(1).dividedBy(f1) ) const c = d.multipliedBy(d).minus( f2.multipliedBy(f2) ) return asset1Balance.multipliedBy(solveQuadraticEq(a,b,c)) }

Compute the quadratic formula. This is a helper function for ammAssetIn(). Parameters and return value are BigNumber instances.

function solveQuadraticEq(a,b,c) { const b2minus4ac = b.multipliedBy(b).minus( a.multipliedBy(c).multipliedBy(4) ) return ( b.negated().plus(b2minus4ac.sqrt()) ).dividedBy(a.multipliedBy(2)) }